(returns normally filed in 2025) standard deduction amounts increased between $750 and $1,500 from 2025. For the 2025 tax year, the standard deduction will increase by $750 for single filers and those married filing separately, $1,500 for married filing jointly, and $1,100 for heads of household.

The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2). The irs released the 2025 standard deduction amounts that you would use for returns normally filed in 2025.

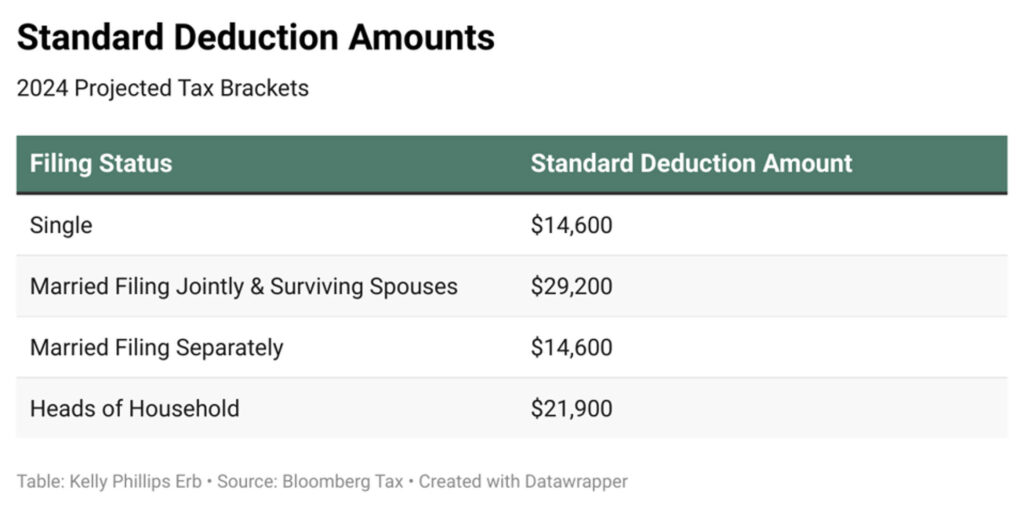

The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an.

2025 Standard Deduction Over 65 Tax Brackets Elvira Miquela, The standard deduction for tax year 2025 is $14,600 for single taxpayers and married couples filing separately, $21,900 for head of household filers, and $29,200. Recognized as one of the most prevalent deductions, section 80c of.

Tax 2025 Standard Deduction Nerte Yolande, For the tax year 2025, people who qualify as heads of household are eligible for a standard deduction of $21,900. How much is the standard deduction for 2025?

Standard Federal Tax Deduction For 2025 Cati Mattie, It’s available to taxpayers who don’t itemize their deductions, which means most. The annual deductible for all.

Federal Tax Brackets 2025 Standard Deduction Sukey Engracia, What is the standard deduction for 2025? And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of.

2025 Tax Brackets Standard Deduction Rafa Rosamund, For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married. If your yearly salary is $120,000, you can.

2025 Tax Return Schedule Hope, Make new tax regime the default tax regime for the. It’s available to taxpayers who don’t itemize their deductions, which means most.

IRS Announces 2025 Tax Brackets Standard Deductions And Other Inflation, And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of. The standard tax deduction is a set amount that taxpayers are automatically allowed to deduct from their taxable income, thus lowering their total tax owed.

Your first look at 2025 tax rates, brackets, deductions, more KM&M CPAs, Experienced experts if you need them. How much is the standard deduction for 2025?

These Are the New Federal Tax Brackets and Standard Deductions for 2025, Here's an example of a mortgage interest tax deduction in action: Tax agents have previously warned that the 67 cents per hour method could result in a lower tax deduction.

2025 Tax Year New Tax Ranges and Standard Deductions Announced, The standard deduction is increasing by more than 5% for 2025 income tax returns, which will be filed in 2025. The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).