941 Deposit Due Dates 2025. Your total taxes after adjustments and nonrefundable credits (form 941, line 12) for either the current quarter or the preceding quarter are less than $2,500, you didn’t incur a. It’s important to note that deposit.

When is the deadline to file form 941 for the 2025 tax year? Here’s when you can expect to receive your ssi payments via direct deposit.

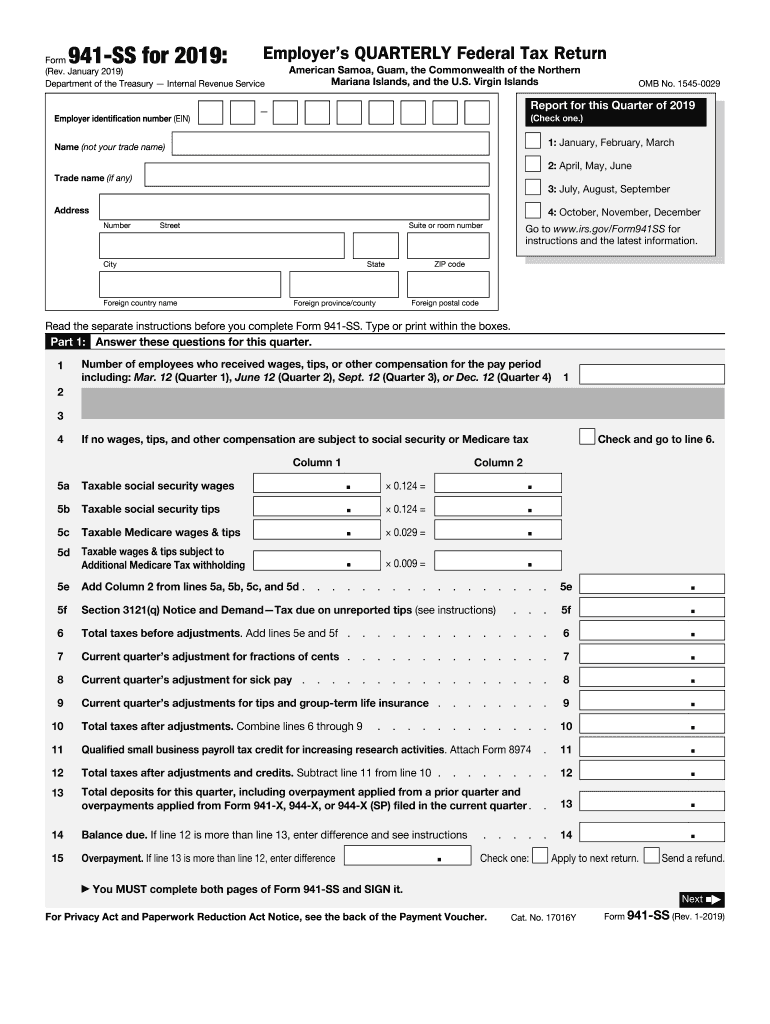

941 irs Fill out & sign online DocHub, Taxpayers should ensure that any necessary updates or. The irs finalized form 941 and all schedules and instructions for 2025.

IRS Form 941 Schedule B 2025, When will i get my ssi money each month? Final versions of the quarterly federal.

How to fill out IRS form 941 20222023 PDF Expert, Also, penalties for failing to make payroll and excise tax deposits due on or after jan. While the 941 form is filed quarterly, the deposit schedules are not quarterly.

941 irs Fill out & sign online DocHub, 21, 2025, and before feb. For 2025, the “lookback period” is july 1, 2025, through june 30, 2025.

Form 941 is Due TODAY! 123PayStubs Blog, The table below provides a summary of the essential compliance deadlines you need to know: View due dates and actions for each month.

What is the due date for 941 deposits? YouTube, If your payday is on saturday, sunday, monday, and/or tuesday, you must deposit these taxes by the following friday. Taxpayers should ensure that any necessary updates or.

Form 941 Schedule B 2025 Map Of United States Of America, What’s your deposit schedule for 2025? Look at your lookback period for forms 941 and 944.

Quick Guide DIY 941 Payroll Tax Deposit with EFTPS, If you timely deposit in full the tax you’re required to report on form 940, 941, 943, 944, or 945, you may file the return by the 10th day of the 2nd month that. Final versions of the quarterly federal.

Schedule B Form 941 For 2025 Gwen Pietra, The revision is planned to be used for all four quarters. Form 941 is required to be filed every quarter while the business is in operation.

2025 Schedule B Form 941 Printable Forms Free Online, Employers must file form 941 every quarter, even if they have no taxes to report, unless they fall into one of the exceptions above. View due dates and actions for each month.