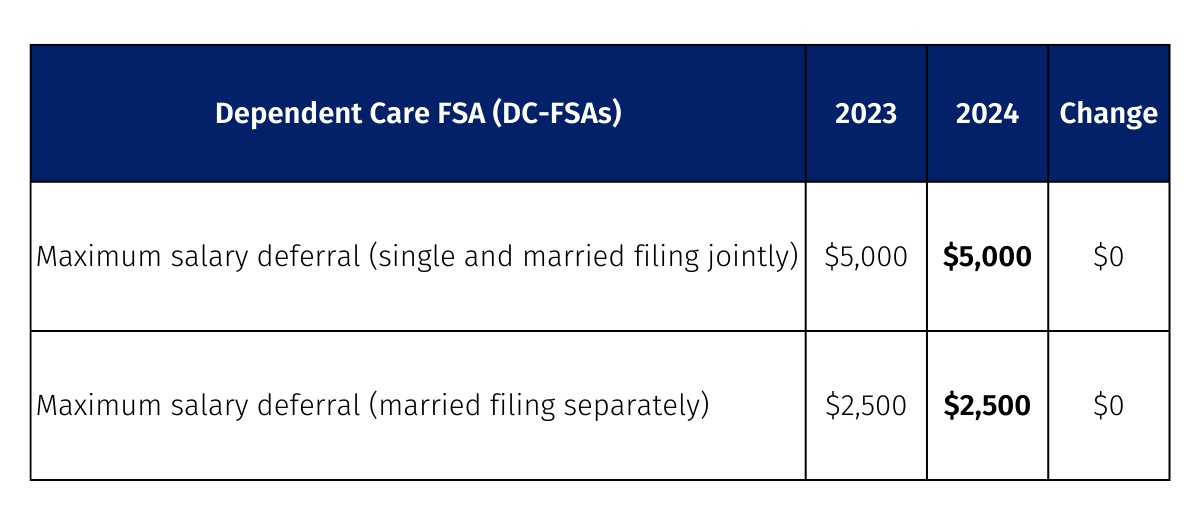

Max Dependent Care Fsa 2025 Limit. For fsas that permit the carryover of unused amounts, the maximum 2025 carryover amount to 2025 is $640. For 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500 for married couples filing separately.

5 to learn about the specific eligibility. Dependent care fsa limits for 2025 the 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households.

2025 Max Dependent Care Fsa Contribution Misty Teressa, 5 to learn about the specific eligibility.

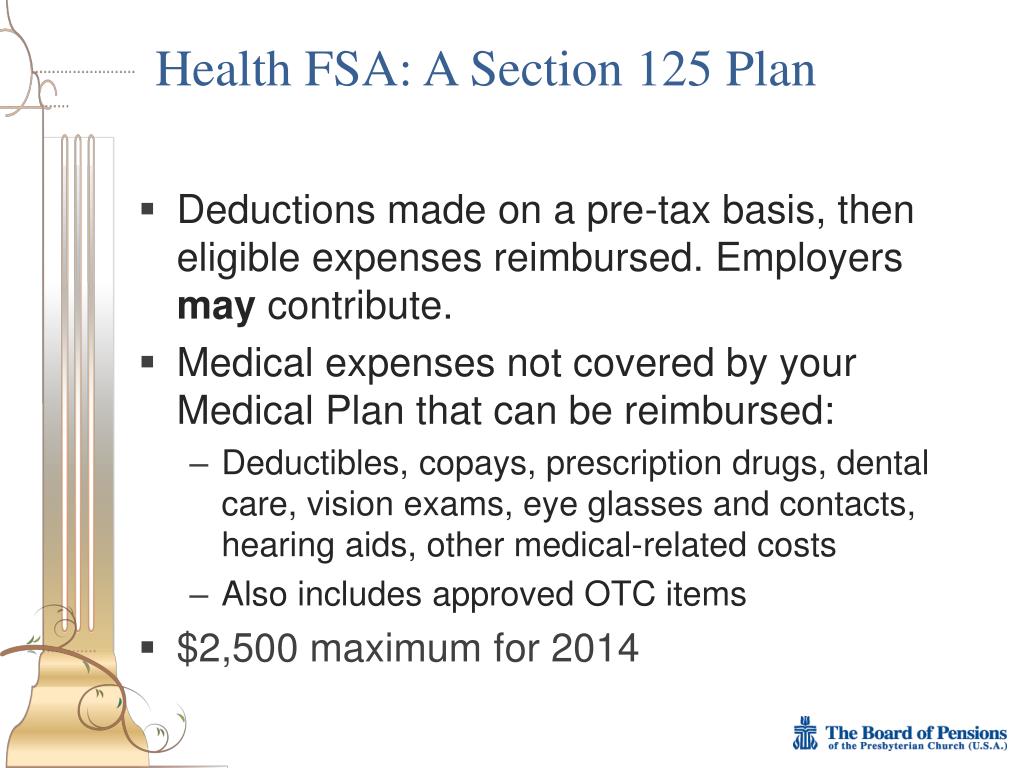

Dependent Care Fsa Maximum 2025 India Belle Cathrin, The 2025 maximum fsa contribution limit is $3,200.

Dependent Care Fsa Limits 2025 Married Nelli Yasmeen, It remains at $5,000 per household or $2,500 if married, filing separately.

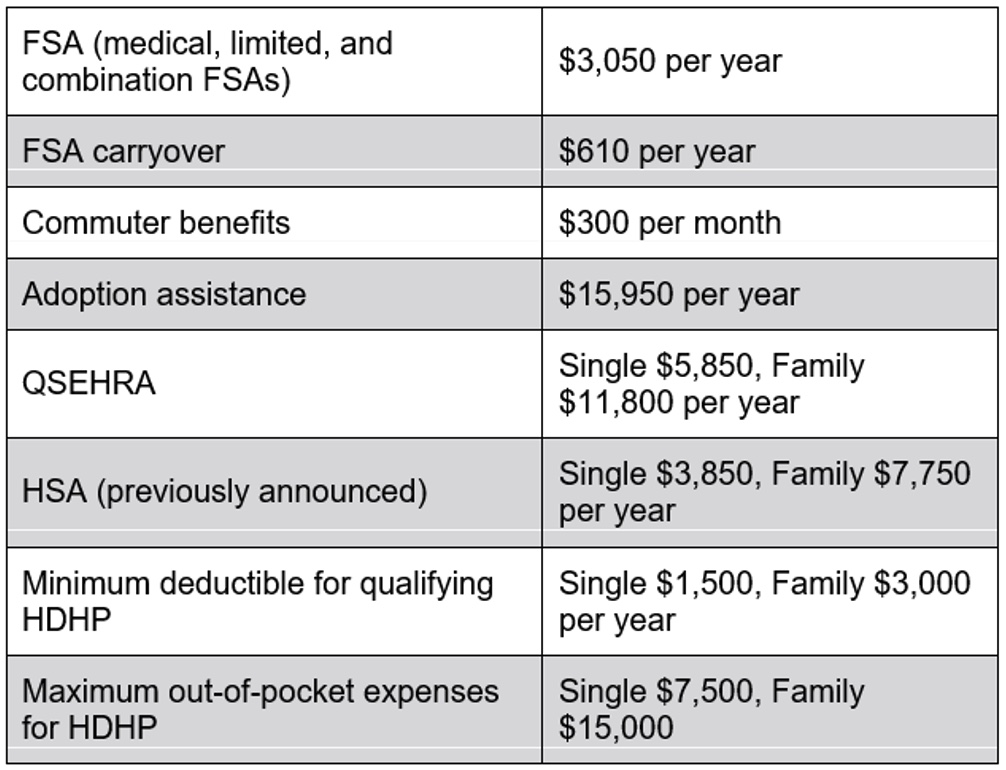

Health Fsa Maximum 2025 Limit Liuka Prissie, The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure.

Dependent Care Fsa 2025 Contribution Limits 2025 Dyann Grissel, For fsas that permit the carryover of unused amounts, the maximum 2025 carryover amount to 2025 is $640.

Dependent Care Fsa Contribution Limit 2025 Olympics Clari Annalee, For unused amounts in 2025, the maximum amount that can be carried over to 2025 is $610.

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Fsa Limits 2025 Dependent Care Tera Abagail, The 2025 maximum fsa contribution limit is $3,200.

Dependent Care Fsa Contribution Limits 2025 Calendar Sada Wilona, What is the 2025 dependent care fsa contribution limit?

Dependent Care Fsa Limit 2025 Limit In India Alyss Bethany, It’s open enrollment season for many organizations and knowing the updated fsa limits will help individuals better plan amounts to set aside.

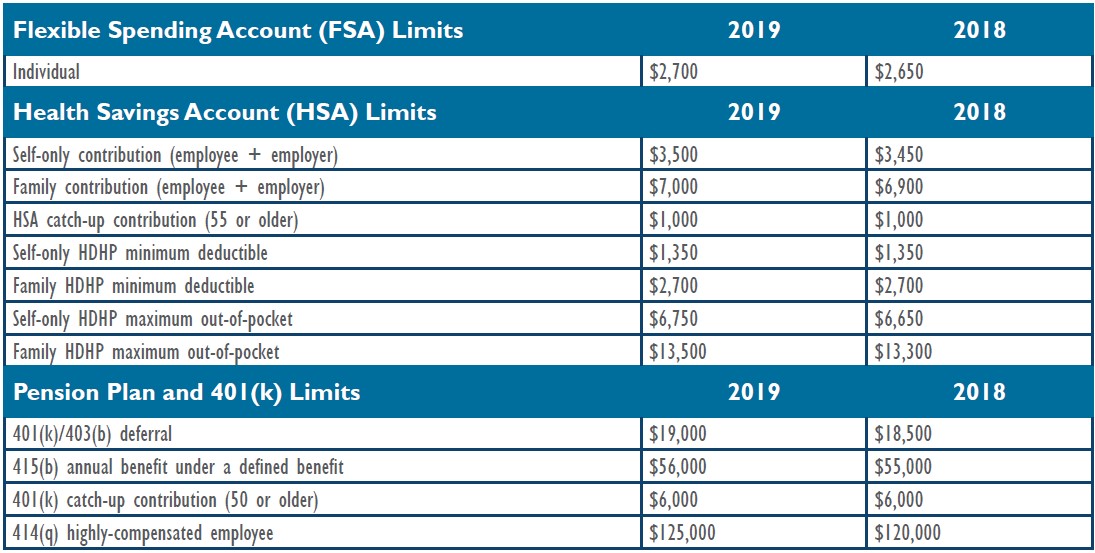

What Is The Maximum Fsa Limit For 2025 Dyna Natala, The table below compares the applicable dollar limits for certain employee benefit programs and the social security wage base for 2025 and 2025.* retirement.

.png)